Feel free to reach out to us by filling the form. We will respond to you back in no time.

Our Credit Restoration Program has reached it’s maximum capacity. We are not accepting any new clients at this time. Please view our e-book, this will guide you in restorating your credit like a pro and don’t forget to schedule a credit success strategy call with us to help you get started.

Our team has several years of experience in evaluating credit and guiding consumers to exercise their legal rights. All American Tax and Credit Adviser LLC not only works to restore our clients credit, but we also provide tools and resources to maintain excellent credit. Our experienced and educated team members have worked with the credit bureaus, creditors, and collection agencies on several occasions and are well equipped to challenge negative items on your credit report to help you achieve your Dreams. Our company is based on the belief that our clients’ needs are of the highest importance. Our entire team is committed to meeting the needs of our clients. Our team of professionals have been certified in credit restoration and understand the FCRA and FDCPA that protects YOU!

A low credit score can keep you from the things you want. But did you know a low credit score can impact a lot more than just financing? Do the best thing you can do for your future. Call us today and let our experience save you time, money, and frustration.

Our service includes your private assessment, contacting creditors on your behalf, sending documentation back and forth, and more. We have been trained on recent laws, statutes, and credit reporting practices. We also know what items on your report affect your score the most.

Did you know 80% of credit reports are not accurate and the inaccurate information can hurt your score? We make sure that your credit report contains correct information and is 100% accurate so you’ll have the highest score possible. The truth is… Creditors know that most consumers don’t understand credit and credit laws that protect them. Our team of experts have studied the law and have many years of experience fighting for our clients to gain the best results. Our team is knowledgeable and have experience with working with the following accounts and achieving the best results.

Get Started with a Credit Analysis to outline your path to achieving your Dreams by understanding what is negatively affecting your credit score.

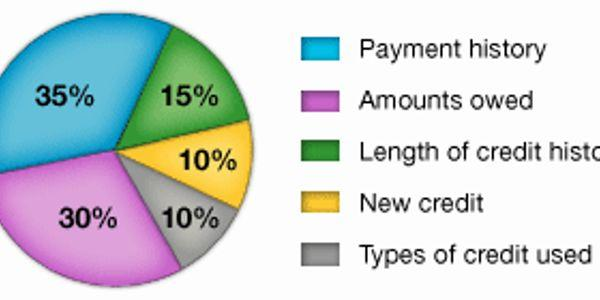

We educate all clients in understanding creditworthiness. Providing resources, tips, and tools to ultimately allow you to understand how credit works.

There are several factors that play into having a great credit score. We offer several products that will assist in rebuilding and maintaining credit excellence.

Our unlimited credit disputes can assist you in challenging the credit bureaus to remove inaccurate, obsolete and erroneous items from your credit report. Our Credit Professionals create custom dispute letters submitted on your behalf to Restore your score and maximize your financial opportunities.

Our team back our services 100% and are always in favor of our clients. Rest assured if there are no positive changes to your credit report within 180 days we offer a full money back guarantee!

It is unsuitable for any credit restoration company to promise a result within a certain time frame. We can no more do that than we could promise a client that he or she would prevail in a court of law. Though we can give you an idea as to how long it could possible take, based on how we have performed in the past, your time frame may vary. If credit reports are received promptly, many clients see exhilarating progress within the first 90 days. Statistically, participating clients have received, on average, 10% deletions by the end of the 1st dispute, 15% deletions by the 2nd dispute, and 25% deletions by the end of third dispute. A deletion is a credit item that has permanently disappeared from the credit report of the client. We organized these statistics from clients who had sent copies of all three credit reports and uploaded all documents received from credit bureaus relating to disputes. Though we realize that these average results are exciting, we must warn you not to interpret past performance as a guarantee or promise that we will achieve precisely the same results for you as we have other clients in the past. Your results may be better or worse. The progress of your case will depend on your participation (keeping credit monitoring, uploading correspondence from credit bureaus, debt collections, or original creditor), the nature of your case, and the level of credit bureau cooperation.

We offer one on one confidential counseling allowing you to indicate to us which items you wish to dispute, and how you want us to dispute them. Once we’ve received your credit reports we will draft letters to dispute negative items on your behalf. These letters are designed to communicate your dispute in such a way that the credit bureaus will accept the dispute and conduct an investigation. While this may sound easy, any person who has attempted to dispute their own credit will tell you otherwise. According to federal law, the credit bureaus can ignore your dispute under a variety of conditions. In our experience, a large part of dispute letters sent directly from consumers are rejected under one pretext or another. At the end of the credit bureaus investigation, a new copy of the credit report is sent to your home along with any deletions or updates. You then copy and send us the new credit report and the cycle repeats itself at timed intervals. A disputed credit listing must be accurate and verifiable for it to remain on the credit report. If the credit listings are inaccurate, the credit bureau may simply change the item to reflect the accurate status. Most often, disputed credit items cannot be verified: the creditor either no longer possesses the information or does not wish to go through the trouble of verifying it. Also, the re-investigation must be completed within 30 days or the listing must be removed. For these reasons, properly disputed credit listings are removed. Each time an investigation is commenced, the odds of receiving a deletion increases.

Yes! You need to know what is on your credit reports, so that you can inform us or give us a copy of your credit report so that we can start repairing and restoring your credit profile. It is like a road map. You need to know where you are at now, and what route you are going to take to get to your destination.

One thing about bad credit is that almost any small amount of bad credit will trigger universal credit denial. A little bad credit isn’t much better than a ton. So, if you believe that there might only be a couple of negative listings on your credit report, it still makes sense to retain us for the time it takes to remove them.

Click here to pull your credit report

It is important to understand there are no guarantees on a certain item on your credit report to be deleted. Just like in a court of law, an attorney could never guarantee a client that the judge or jury would find in their favor. We can guarantee however, that your credit reports will improve over time and your credit scores will also improve over time.

YES! It is very important that you always keep your credit monitoring on with Smart Credit. I can’t restore your credit profile without seeing it. If payments are declined with smart credit you will receive a notification. Please be sure to let me know if you experience any issues with credit monitoring as this is a valuable tool to help you reach your goal.

Although the credit bureaus would like to have you think credit repair is illegal, there is absolutely nothing illegal about disputing items on your credit report. In fact, it is your explicit right by law to do so (see Fair Credit Reporting Act). Credit repair is as legal as pleading “not guilty” in a court of law.

Jonquala’s approach is person-centered and professional. It is her goal to put a smile on everyone’s face each time.

Great service and very professional. They took care of my tax problems ASAP. I wouldn’t recommend anyone else.

All American Tax and Credit Advisors has helped my family tremendously. The owner Jonquala saved us thousands on our taxes. She is

All American Tax and Credit Adviser are truly amazing!!! They took my credit score from 546 to the 711!! The owner Jonquala

Jonquala is so great she’s always quick to respond anytime I have a concern about something. And since I’ve been with her

My decision to use “All American Tax and Credit Adviser” has been overall an excellent decision. Jonquala is an absolute pleasure to

I absolutely Love Jonquala Elom as my credit advisor. Throughout the process she has been very knowledgeable and thorough about everything. She

The people at All American Tax and Credit were very responsive, they gave me realistic expectations for the service that I purchased.

This is a very professional environment. The owner is extremely educated in her profession. She’s kind and professional. She has high standards

Wow! I was so impressed with All American Tax Service. She was on top of it and always available to answer any